ANNIVERSARY SPECIAL: The Pilbara has a diverse and colourful mining history, including gold, tantalum, beryl and lithium.

ANNIVERSARY SPECIAL: The Pilbara has a diverse and colourful mining history, including gold, tantalum, beryl and lithium.

When most people think of mining in the Pilbara, they immediately think of iron ore.

But while iron ore is by far the largest mining sector in the region, it is not the only commodity to have driven the region’s growth.

Mining came to the Pilbara after the discovery of gold near Marble Bar in 1890.

Marble Bar – about 200 kilometres inland of Port Hedland, and renowned as one of the hottest places on the planet – grew to be a substantial town with a population of more than 5,000 people by 1891.

It was a short-lived boom, however, as the discovery of gold near Coolgardie in 1892 and in Kalgoorlie soon after lured most prospectors south.

The next phase of mining activity in the Pilbara occurred not far away, at Wodgina, after the discovery of tantalum in 1902.

Tantalum production began in 1905, with the ore carted to the coast by camel.

The establishment of Tantalite Ltd, chaired by Lady Deborah Hackett, led to a big expansion of tantalum production from the remote and inhospitable site.

The material was used in lamps and radars and was considered strategically important during WWII, so much so that the federal government took over the operations at Wodgina during the war years.

Tin was also mined at Wodgina in the early years.

Another ore found at Wodgina was beryl, which also was strategically important.

For many years, the beryl ore was stockpiled, until the US government found a use for the caesium and beryllium it produced.

Some 900 tons of beryl was shipped to the US during the war, with its main use believed to be in the secret Manhattan project (the development of nuclear weapons).

Mining at Wodgina was sporadic in the post-war years, up until 1989 when industry powerhouse Sons of Gwalia bought the site.

Sons of Gwalia was a major gold miner, while its ‘advanced minerals’ division produced tantalum and lithium at Wodgina and Greenbushes in the South West.

In the year 2000, it committed to spend $100 million expanding its advanced minerals business, illustrating the scale of this business.

Sons of Gwalia fell into administration in August 2004, mainly because of issues in its gold business.

The unlisted Talison Minerals, backed by private equity group Resource Capital Funds, subsequently bought the advanced minerals business for $205 million.

Tantalum production at Wodgina stopped and started several times during the next decade, reflecting the thin and volatile market for the specialist metal.

The new owners had a much bigger focus on Greenbushes, where lithium was the main output.

Greenbushes was originally developed as a tin mining precinct in the 1880s, with tantalum mining starting in the 1940s, followed by lithium in 1983.

Its capacity has grown dramatically since then.

In light of the changing business mix, Talison Minerals was split into two companies in 2009.

Talison Lithium acquired the Greenbushes mine and Talison Tantalum, which later became Global Advanced Metals (GAM), acquired Wodgina.

Atlas rise, and fall

Wodgina appeared to have a new future in 2008 when budding miner Atlas Iron purchased the iron ore rights, leaving GAM with the tantalum rights.

Two years later, in July 2010, Atlas began iron ore production.

Its ability to quickly kick-start operations was helped by its access to the existing processing plant for the tantalum mine.

Atlas rode the China-fuelled iron ore boom but the low quality of its ore, its high operating costs and large debt load always cast doubts over its long-term prospects.

In June 2016, when Atlas was struggling to stay in business, Mineral Resources surprised the market by announcing an agreement to buy the Wodgina assets.

These included the tenements and all associated infrastructure, and rights to mineral deposits other than tantalum.

The infrastructure assets include a 13-megawatt gas-fired power station, a 387-bed camp, and a mineral processing plant.

The value of the acquisition was not disclosed, indicating MinRes did not have to pay very much.

In evaluating this opportunity, MinRes had the advantage of two directors with a deep knowledge of Wodgina.

James McClements was chairman of GAM, as well as being a partner of GAM’s majority owner, Resource Capital Funds, while Kelvin Flynn is a director on the board of GAM.

The big attraction for MinRes was Wodgina’s lithium deposits, promoted by the company as the world’s largest known hard rock lithium resource.

Led by managing director Chris Ellison, MinRes moved quickly to get these assets into production; just six months after buying the Wodgina assets, it began mining operations.

Two months after that, the world’s first shipment of lithium direct shipping ore set sail from Port Hedland.

The very same month, April 2017, Atlas Iron terminated its iron ore mining operations.

Mineral Resources brought considerable experience in lithium to Wodgina – it already operates the Mt Marion mine in the Goldfields.

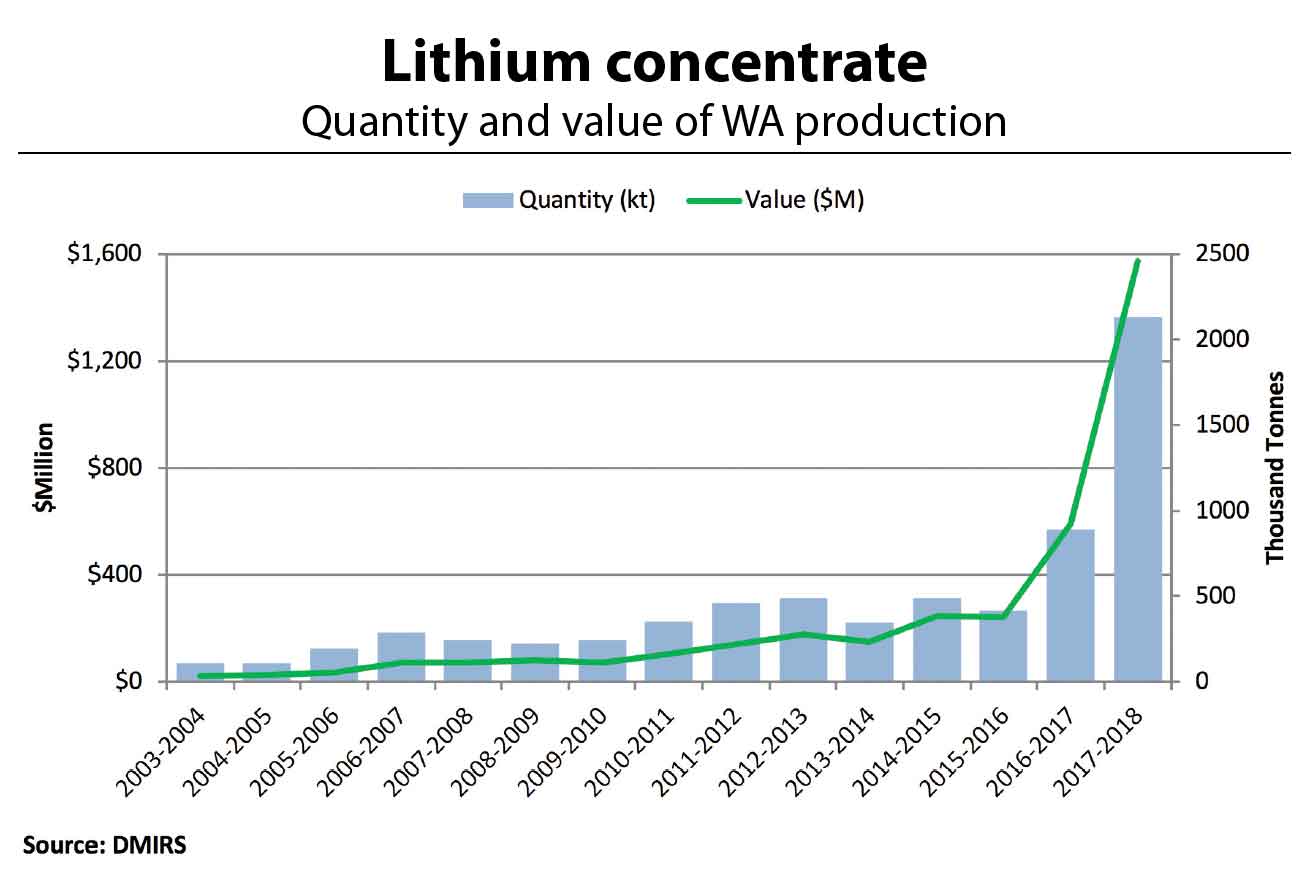

It was not alone in pursuing growth opportunities in lithium, which is a key ingredient in the batteries used in mobile phones, computers and electric cars.

About 30 kilometres from Wodgina, Pilbara Minerals and Altura Mining have built their neighbouring lithium projects at Pilgangoora.

In the south of the state, Galaxy Resources has its Mt Cattlin mine while Greenbushes is continuing to expand.

Wodgina future

The main focus at Wodgina right now is the construction of a lithium concentrate (aka spodumene concentrate) plant capable of processing 750,000 tonnes of ore per year.

MinRes is spending $230 million on infrastructure, including a gas pipeline, an expanded power station, water supply, an expanded accommodation village and an airport.

It is spending a further $380 million on the mine and process plant, including three identical concentrate trains.

The company expects to start commissioning of the concentrator in the third quarter of FY19; i.e. around March next year.

That’s after disclosing an estimated eight-week delay in completion of the project because of late delivery of long-lead items from the manufacturers, and congestion in Perth fabrication and rubber lining facilities.

To put Wodgina in context, it will exceed the current processing capacity of all other ASX-listed lithium companies but will be substantially smaller than the Greenbushes operation.

Talison Lithium is currently expanding the capacity of its lithium concentrate plant at Greenbushes to 1.34 million tonnes per annum and has approved a further expansion to 1.95mtpa.

Like Talison’s two joint owners – Chinese company Tianqi Lithium and US company Albemarle Corporation – MinRes plans to move up the value chain by also building a lithium hydroxide plant.

It is aiming to build two hydroxide-processing lines at Wodgina at a cost of about $800 million.

To help fund that, the company has called for expressions of interest from parties wanting to acquire a minority stake in Wodgina.

MinRes said last month it had been approached by local and global companies, but would only sell if the new partner could add significant value, pay an appropriate price and bring a complementary culture.