BMG Resources has expanded its portfolio of Western Australian gold and lithium projects, acquiring the Bullabulling project in the Eastern Goldfields' emerging Coolgardie lithium and gold region. The company exercised its option on the project after initial reverse-circulation drilling confirmed strong prospectivity for lithium and gold. Plans for follow-up drilling is underway and more assays are due in the coming weeks.

BMG Resources has expanded its portfolio of Western Australian gold and lithium projects, acquiring the Bullabulling project in the Eastern Goldfields' emerging Coolgardie lithium and gold region.

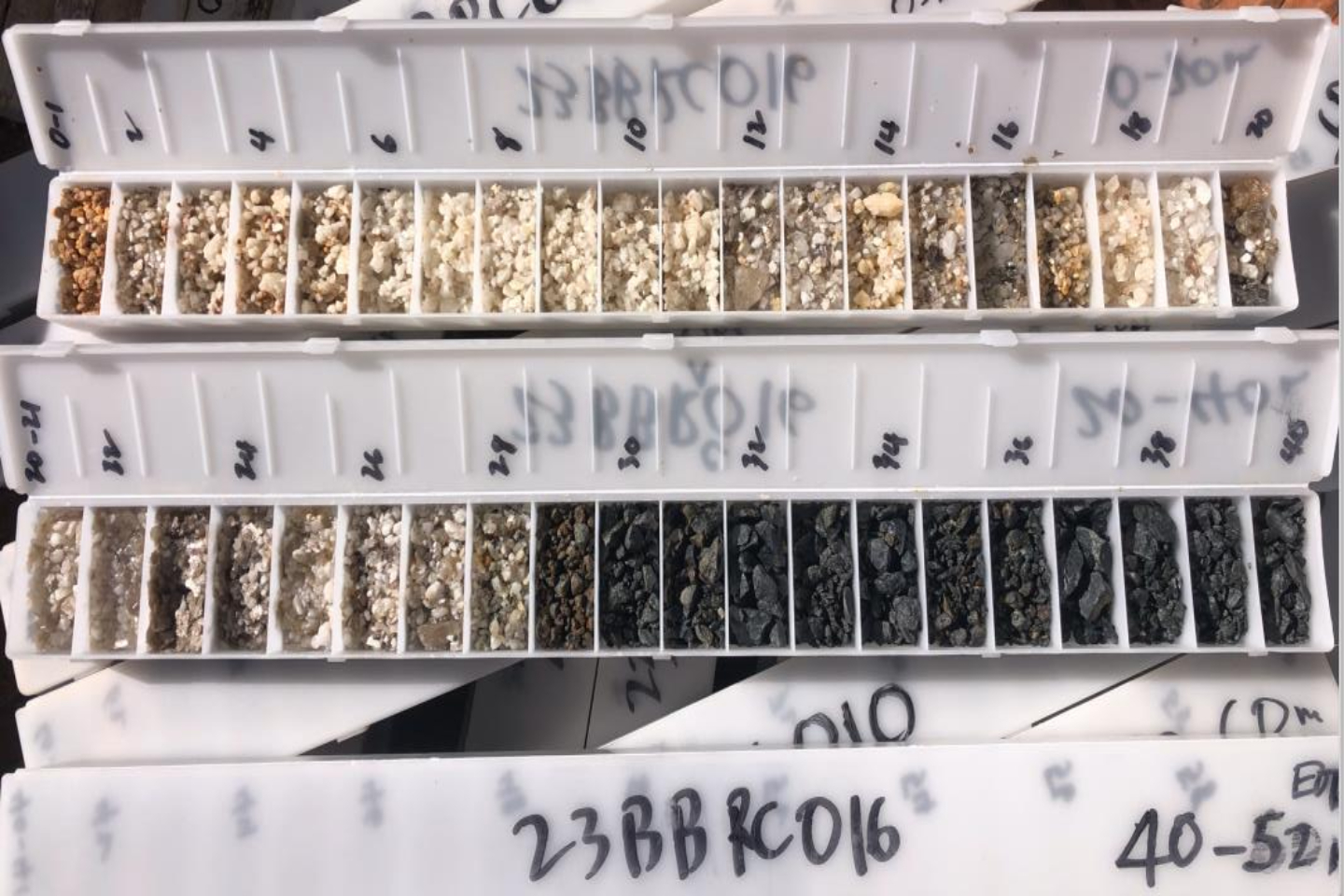

The company exercised its option to acquire the project following what it says was a highly-encouraging maiden reverse-circulation (RC) drilling program.

Initial RC drill assays returned anomalous lithium and gold intercepts, confirming strong prospectivity for lithium and gold across the 185-square-kilometre project area, which lies immediately adjacent to and along strike from the multi-million-ounce Bullabulling gold mine.

At Bullabulling ’s Poolmans prospect, BMG returned a significant result of 4m grading 2.37 grams per tonne of gold from 53m deep. The result coincided with a quartz vein estimated at just over 1m in true width, implying a grade in the vein of greater than 8g/t gold.

BMG now hopes to delineate the vein along its near-surface extents in follow-up drilling. Management says local prospectors anecdotally corroborate government records that show Poolmans was a high-grade mine before being closed due to water ingress and a lack of manpower during war-time.

The company’s other priority assay results come from its Ubini prospect, including 3m grading 0.31 per cent lithium oxide from 12m and 4m grading 0.16 per cent lithium oxide from 13m, pointing to early potential for the discovery of significant lithium-bearing pegmatites.

BMG’s drilling builds on historic exploration at the site that identified widespread lithium-caesium-tantalum (LCT) pegmatites, several of them containing lithium mineralisation assaying greater than 1 per cent lithium oxide.

Prior to the maiden RC campaign, other work by BMG confirmed the LCT characteristics of the pegmatites through geochemical assay ratio analysis. Management also underlined the exploration potential of the system for economically significant lithium mineralisation by citing the presence of evolved mineral phases such as tantalite, cassiterite, amblygonite, zinnwaldite, lepidolite and spodumene, coupled with favourable textures.

BMG Resources’ managing director Bruce McCracken said: “BMG is delighted to bring the Bullabulling Project into our portfolio of Western Australian gold and lithium projects and secure a foothold in the emerging Coolgardie lithium and gold region. This highly prospective lithium and gold project presents a robust investment case for BMG, and an outstanding opportunity to generate shareholder value through early-stage exploration. The Coolgardie region boasts a long history of mining where the ground is well understood. Bullabulling is located close to infrastructure and major discoveries, including Mt Marion to the east and Nepean and West Spargoville to the south.”

The rest of the company’s RC assays are due back from the lab in the coming weeks and will help inform its next round of drilling to further test the strike extent of the anomalous LCT pegmatites, in addition to other priority targets.

BMG expects the acquisition of the project and its holding vehicle, Fairplay Gold, to be finalised in coming weeks with a cash payment of $200,000 and 15 million of its fully-paid ordinary shares.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au