Aurum Resources’ bid for Mako Gold could create a new West African golden-force with $20 million in cash, its own fleet of drill-rigs and a string of well mineralised projects within cooee of each other. And this isn’t the first rodeo for Aurum managing director Caigen Wang who has done it all before in Côte D’Ivoire having built the 3.8m ounce Abujar gold mine on the same structural trend.

Aurum Resources’ bid for fellow ASX-listed company Mako Gold could create a new West African golden-force with $20 million in cash, its own fleet of drill-rigs and a string of well mineralised projects within cooee of each other.

And this isn’t the first rodeo for Aurum managing director Caigen Wang who has done it all before in Côte D’Ivoire. Wang, formally the founder and managing director of Tietto Minerals, was the driving force behind the discovery of 3.8m ounces of gold at Tietto’s Abujar project on the same structural trend as Mako’s existing gold assets in Côte D’Ivoire. He is something of a rarity amongst ASX players having managed to navigate the African system to actually build a gold mine at Abujar – and a big one - that is capable of producing more than 250,000 ounces a year. That mine spat out its first gold bar in January 2023 and led to Tietto being taken out by Chinese interests for very nearly three quarters of a billion Australian dollars.

Aurum is Wang’s second crack at producing another successful gold mine in Côte D’Ivoire. Just a year after vending his own private tenements and farm in deals into Aurum, the company has a plan to scale exponentially by swallowing up Mako Gold and its gold and manganese projects about 100kms to the east in an all scrip plan that the Mako board is recommending.

If the company’s bid for Mako is successful, the combined entity will be underpinned principally by Aurum’s Boundiali gold project that has been throwing up some monster drill hits and Mako’s 90 per cent owned Napié gold project that comes gift-wrapped with an 868,000 ounce gold resource grading 1.2 grams per tonne .

Aurum has the right to variously earn between 70 per cent and up to 88 per cent of the four key project areas at Boundiali known as the BD gold project JV, the BST gold project, the BM gold project JV and the BN gold project JV

Boundiali is in a prime location, 50km south of gold mines such as Resolute Mining’s 11.5 million-ounce Syama and Perseus Mining’s 1.4 million-ounce Sissingue deposit.

Aurum is on the cusp of revealing its maiden resource for Boundiali where significant drill results have been received across the four tenement areas.

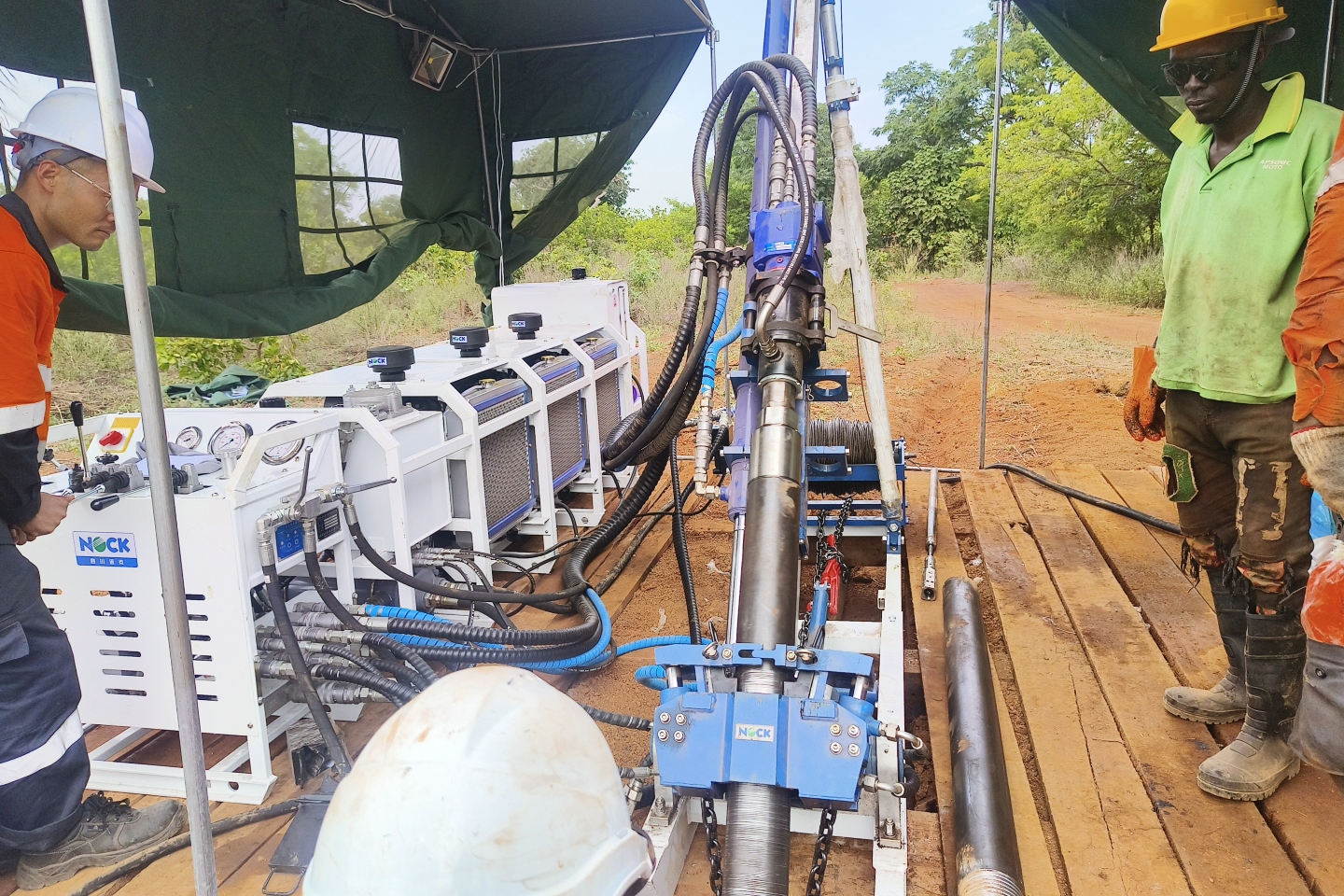

At the BD joint-venture that it currently has an 80 per cent interest in, the company has conducted 33,700m of diamond-core drilling since last December, notably, using its own fleet of diamond-drill rigs, a cost effective strategy undertaken by Wang when he built Tietto’s 3.8m ounce resource.

Stellar thick intersections of 73m at 2.15g/t gold from 172m, 90m going 1.16g/t gold from 143m and 69m running 1.05g/t demonstrate its potential to contribute seriously to the highly anticipated maiden resource.

The company says a 13km-by-3km gold corridor exists within its BD ground, providing for a significant opportunity for further drilling.

Other notable historic assays returned from Aurum’s BST gold project including a whopping 20m hit going 10.45g/t from 38m, 30m grading 8.3g/t from 39m and 28m running 4.04g/t from a shallow 3m depth.

Aurum has a grab bag of geological indicators scattered across all of its projects that look like they are begging to see a drill bit and it is also planning to hit Mako’s projects hard with the drill-bit if it gains control of that asset base.

The key attraction at Mako is its 868,000 ounce 1.2 gram per tonne resource spread across two deposits at Mako’s Napié project that Aurum thinks will fast track a combined operation into production when added to its own ounces. Napié is about 100kms east of Boundiali.

Notably however Mako also has the promising Korhogo manganese project about 20kms north of Napié where 8 out of 10 initial holes hit mineralisation. Mako also has a number of IP anomalies at Korhogo that look interesting.

Aurum’s bid for its West African counterpart provided a much-needed boost to the Mako share price. The offer of one Aurum share per 25.1 Mako shares implies an offer price of 1.8c based on the preceding 30-day average price. Mako’s shares, that had been wallowing at under a cent, leapt to trade at 1.8c after the market got to take a look at the proposed coming together of the two ASX-listed companies. Under the terms of the deal, the combined entity will be owned 79.5 per cent by Aurum shareholders and 20.5 per cent by Mako shareholders.

The coming together of Mako and Aurum would appear to make sense at face value. It will deliver a combined entity with a starter resource of 868,000 ounces however with massive hits like 73m and 2.15 g/t gold and 20m going 10.45 g/t gold and a dizzying array of untested targets, Aurum’s assets are likely to do the heavy lifting and its maiden resource due out by the end of this year will provide a significant shot in the arm to the next entity.

The Mako board has unanimously recommended the deal and big shareholders that speak for 17.8 per cent of Mako’s stock, including Dundee Resources, Delphie, AG Sparta and Geodrill have given a tentative nod to the deal in the absence of a better offer.

One of the hardest parts about doing business in Africa is doing business in Africa and it can get difficult if you don’t know your way around the system – hence the discount that is often worked into African gold companies.

Having already discovered 3.8m ounces in Africa and actually built a 260,000 ounce a year gold mine that was taken out for US$473m by the Chinese, Wang inhabits a piece of rarified air amongst ASX-listed company MD’s and he brings some serious horsepower and knowhow to the deal that just might give birth to the next African gold mine owned by an ASX-listed company.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au