TNG Ltd has hit a major milestone at its Mount Peake vanadium-titanium-iron project in the Northern Territory with the grant of four mineral leases over the development. This adds to the recent signing of the Native Title Agreements and binding term sheet for titanium offtake, providing the company with the security of tenure it needs to seek project financing.

TNG Ltd has hit a major milestone at its Mount Peake vanadium-titanium-iron project in the Northern Territory with the grant of four mineral leases over the development.

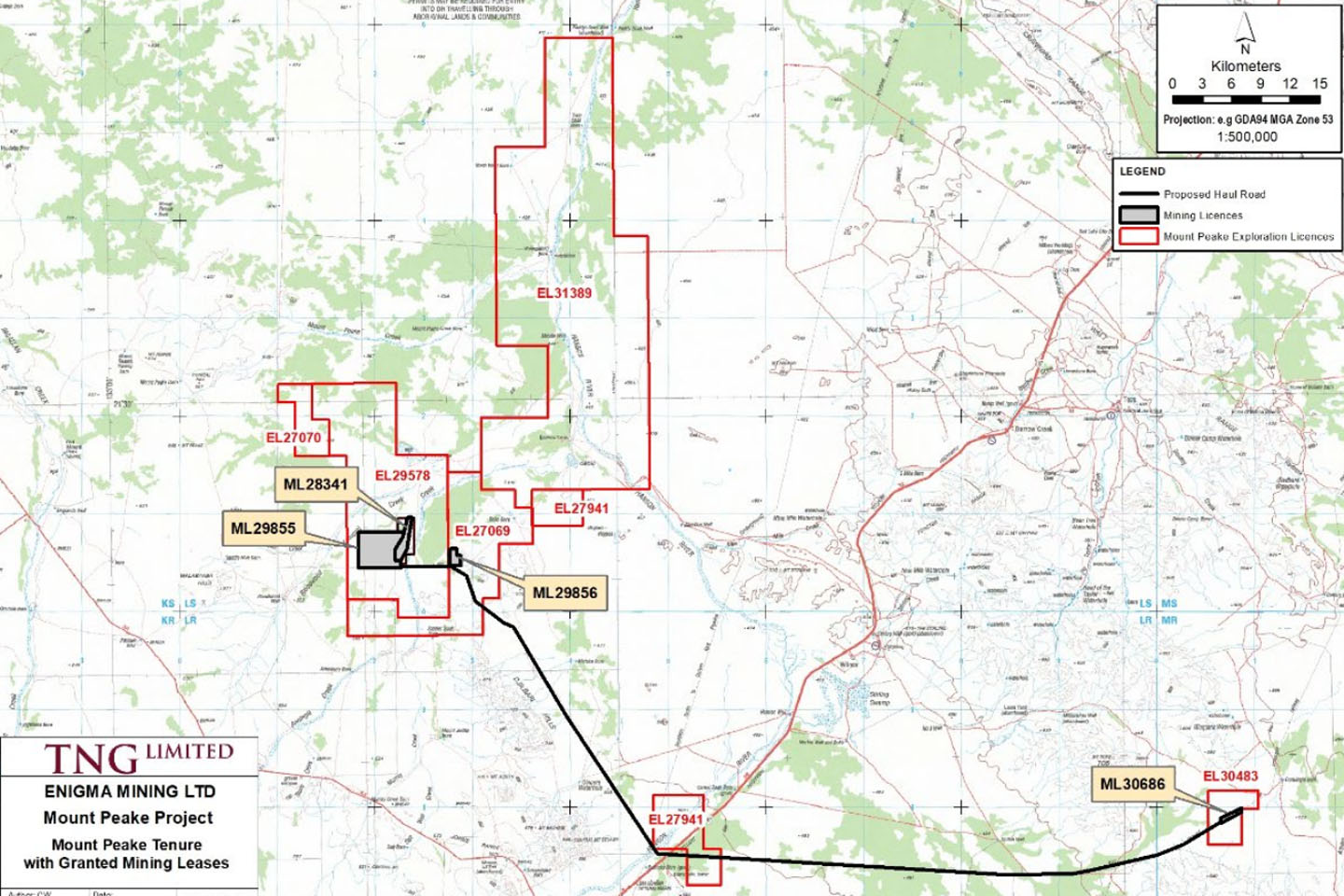

These cover the proposed open pit mine, the associated mine and plant infrastructure, the camp site, and the rail loading facility area.

Importantly, the grant follows the laundry list of milestones that the company has ticked off in recent months and provides the security of tenure needed to seek project financing.

These include signing the Native Title Agreements and a binding term sheet for titanium offtake with Swiss commodity trader DKSH in October and the appointment of German metallurgical engineering company SMS Group to start front end engineering and design work for the project.

SMS will provide a binding, fixed-priced turn-key engineering plan, a procurement and construction proposal for the concentrator and a processing plant.

Importantly, SMS will also provide a production quantity, rate and product quality guarantee that will significantly de-risk the project for TNG.

The company said that using a single contractor is expected to provide support for its strategy of sourcing Government guaranteed export credit agency project debt financing for Mount Peake.

Mount Peake has an Ore Reserve of 41.1 million tonnes with a respectable grade of 0.42% vanadium pentoxide, 7.99% titanium dioxide and 28% iron.

It is forecast to produce 243,000 tonnes of high-purity V2O5, 3.5 million tonnes of titanium pigment and 10.6 million tonnes of high-grade iron oxide during its initial 17 year mine life.

With the reserve representing just 30% of the measured and indicated mineral inventory, there is considerable scope for TNG to extend the mine life further too if commodity prices hold up.

In addition to the recent titanium offtake term sheet, the TNG also has a binding offtake agreement with WOOJIN Metals for at least 60% of the vanadium output and a binding term sheet with Gunvor (Singapore) for the iron products.

TNG Managing Director Paul Burton said: “We are rapidly ticking off the boxes towards the Mount Peake development. With these important milestones now complete, we will be squarely focused on moving ahead with project financing negotiations.”

Earlier this month, the company received a $1.55 million refundable tax offset under the Australian Federal Government’s R&D tax incentive scheme in relation to test work for the commercial extraction of high-purity vanadium, titanium and iron from vanadiferous-titanomagnetite using its patented TIVAN hydrometallurgical process.

TNG also secured a $10 million strategic investment from Indian mining conglomerate Vimson Group and it has signed a binding heads of agreement with industry-leading German technology provider Ti-Cons for the supply of a full titanium dioxide pigment production technology package in September.

With the mineral leases now in place, TNG can now go all out on its quest to secure project funding, safe in the knowledge that its tenure is now firmly in place.

TNG’s timing is exquisite too with vanadium pentoxide prices having maintained their upward trend globally with Metal Bulletin saying that Chinese export prices were between USD$31 to USD$33 per pound at the beginning of this month.

In addition, the TiO2 market is forecast by Technavio to grow at a compound annual growth rate of 3.82% between 2018 and 2022.