Business goliath Wesfarmers will pump $26m into Ora Banda Mining to buy 65 per cent of the lithium rights at the company’s Davyhurst gold project north of Kalgoorlie. The move follows the discovery of lithium at Davyhurst back in April and will also see Ora Banda pick up a 2 per cent royalty. Ora Banda plans to monetise its royalty up front, courtesy of a partial sale to a third party.

Business goliath Wesfarmers will pump $26m into Ora Banda Mining to buy 65 per cent of the lithium rights at the company’s Davyhurst gold project north of Kalgoorlie. The move follows the discovery of lithium at Davyhurst back in April and will also see Ora Banda pick up a 2 per cent royalty. Ora Banda plans to monetise its royalty up front, courtesy of a partial sale to a third party.

The gold producer’s shares surged more than 20 per cent on the back of the latest announcement to touch 16.5 cents in intra-day trading after closing at 13.5 cents last week.

The two companies will form a 65/35 JV with Wesfarmers subsidiary Brenahan Exploration taking the majority share. Ora Banda is free-carried up to the completion of a definitive feasibility study while Brenahan has an option to solely fund $15 million in exploration over three years to increase its stake to 80 per cent.

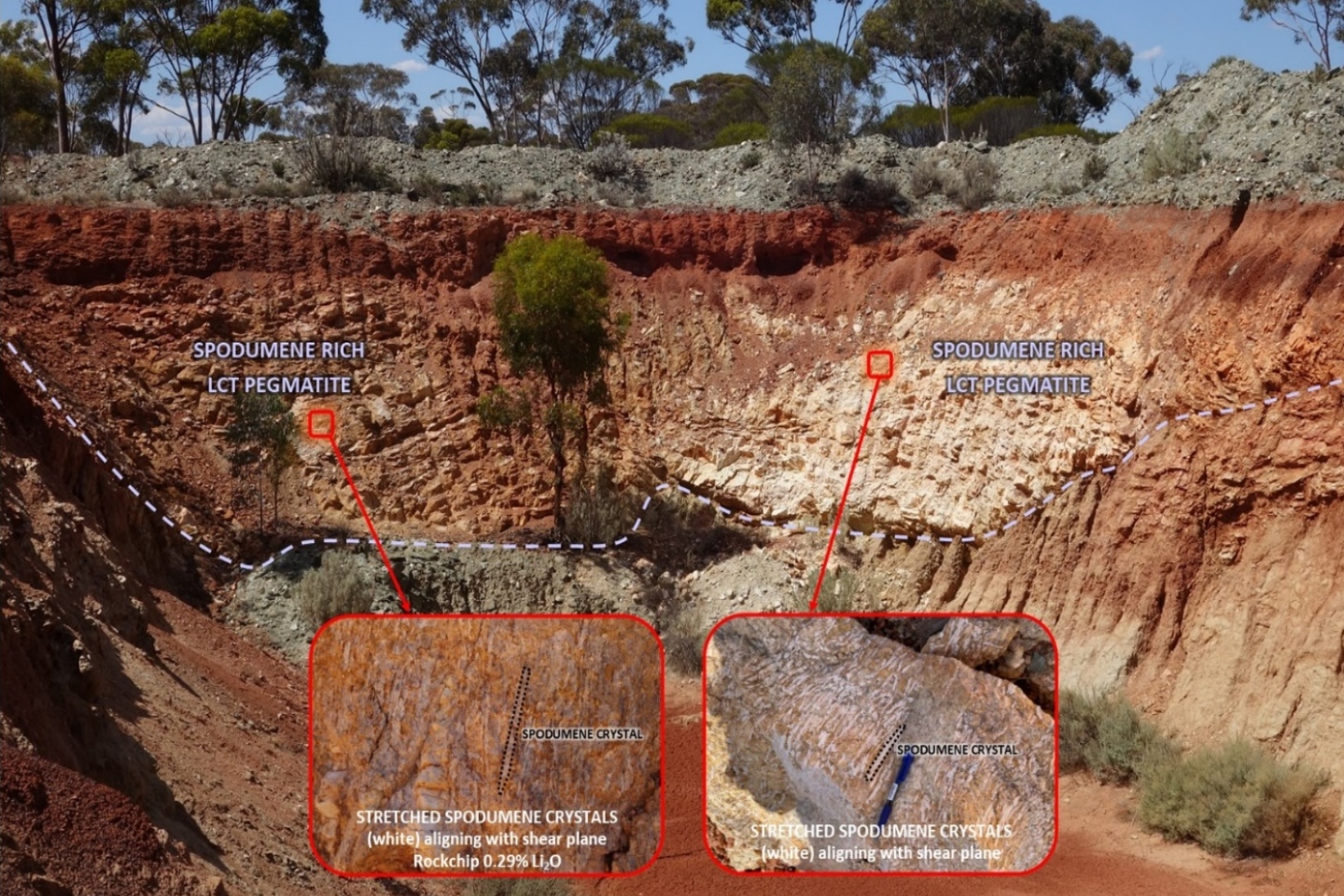

Ora Banda’s lithium results from an initial three-hole exploration campaign earlier this year were at the company’s Federal Flag prospect, just 10km from its Davyhurst gold processing plant. The traditional gold explorer has confirmed the presence of lithium-caesium-tantalum pegmatites, along with potential lithium-bearing spodumene, with an 11.1m hit going 1.28 per cent lithium oxide from 54m.

According to the JV agreement, Brenahan will pay $22.1 million in cash on completion of the deal, with the remaining $3.9 million to come on the completion of a formal mineral sharing, JV and royalty agreement, or by the end of April next year – depending on what comes first.

Ora Banda will also on-sell 1.5 per cent of its 2 per cent royalty to mining financier Hawkes Point for $4 million, increasing its total consideration from the deal to $30 million. While the agreement is subject to shareholder approval, Ora Banda retains all gold rights to the Davyhurst operations and maintains exclusive access over gold mining areas.

Ora Banda Mining managing director Luke Creagh said: “In total, we view this as a $45 million dollar deal with $30 million in cash and $15 million in exploration expenditure. The deal structure is aligned to maximise the potential of multiple discoveries to the benefit of both parties, whilst providing balance sheet strength to Ora Banda to further grow gold production.”

The company recently recalculated its mineral resource which now stands at 1.8 million ounces at 2.7 grams per tonne gold. Reserves, which are being rapidly expanded at the project with the drill bit now sit at 160,000 ounces going 2.6g/t gold, which includes 145,000 ounces grading 3g/t gold. The calculations exclude low grade ore and stockpiles, however the reserve grade was increased recently by 50 per cent to 3g/t gold.

The new resource estimation was calculated using a A$2,400/oz gold price and cut-off grades for the ore reserve were mainly based on a A$1,850/oz gold price to ensure focus remains on conversion of higher margin ounces.

The revised stats come following the change in focus to concentrate on higher-grade underground ore at Davyhurst. The company also revealed a $9.8 million exploration budget for next year to drill underground targets, Missouri and Sand King, with the aim of developing a second underground mine.

Ora Banda also recently increased the head grade of ore processed at its Davyhurst processing operation by 22 per cent up to 2 grams per tonne following improvements in the crushing and milling circuit. The work lifted its fresh rock capacity to between 80 and 100 per cent of feed compared to 66 per cent during the past financial year.

The revised mineral resource follows mining depletion and the $10 million deal to sell its non-core Lady Ida tenements, 65km south of Kalgoorlie, in a move designed to sharpen the company’s focus on high-grade underground gold deposits.

Last year Ora Banda outlined a tactical reset after a detailed review of its flagship Davyhurst mining and processing operations, which sit about 120km north-west of Kalgoorlie in Western Australia’s famed Goldfields region.

Part of the new strategy includes developing the Riverina underground complex based on the existing infrastructure in the area. Ore from Riverina is processed at Davyhurst, with recoveries of about 92 per cent.

Ora Banda is now going full speed ahead with its Riverina underground expansion and its now well-funded substantial exploration program. The company has a goal of producing 100,000 ounces of gold per annum by 2025 and the latest deal with Wesfarmers will no doubt provide a welcome shot in the arm as the company goes about kicking the door down in the 100,000 ounce a year club.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au