Thunderbird Resources has slipped into prime gold-antimony territory in NSW with its imminent acquisition of two exploration licences, one of which partly encloses Larvotto Resources’ Hillgrove project. Hillgrove hosts Australia’s largest antimony deposit, with a mineral resource of 7.3 million tonnes going 4.4g/t gold and 1.3 per cent antimony for about 1.04 million ounces of gold and 93,000 tonnes of antimony

Thunderbird Resources has slipped into prime gold-antimony territory in NSW with its imminent acquisition of two exploration licences one of which one partly encloses Larvotto Resources’ Hillgrove project.

Hillgrove hosts Australia’s largest antimony deposit, with a mineral resource of 7.3 million tonnes going 4.4g/t gold and 1.3 per cent antimony for about 1.04 million ounces of gold and 93,000 tonnes of antimony.

Thunderbird has entered into a binding share purchase agreement with the shareholders of Kooky Resources to acquire all of the issued share capital of Kooky which holds a 100 per cent interest in the two licences for a total initial consideration of $150,000 of which $80,000 has already been paid.

Further payments include 30,000,000 fully paid ordinary shares in Thunderbird issued upon completion of the acquisition, and a deferred consideration will comprise an additional 20,000,000 shares, upon the earlier of Thunderbird satisfying access requirements to certain target areas.

Two other contingent payments totalling $900,000 are due upon completion of drilling and production of a specified mineral resource estimate.

An additional $800,000 is payable - in cash or shares - upon the announcement of a PFS with certain specifications applicable across the project.

Additionally, Thunderbird will grant the vendors a 1.5 per cent net smelter return royalty on all metals produced from the projects after commencing commercial production and a payment of 9,375,000 fully paid ordinary shares in Thunderbird will also be paid as a finder’s fee.

The combined area of the two licences is 488 sq km which Thunderbird views as having strong prospectivity for high-grade antimony and gold mineralisation.

The southernmost Rockvale project consists of a single licence separated into five parts which stretch over a maximum distance of about 55km.

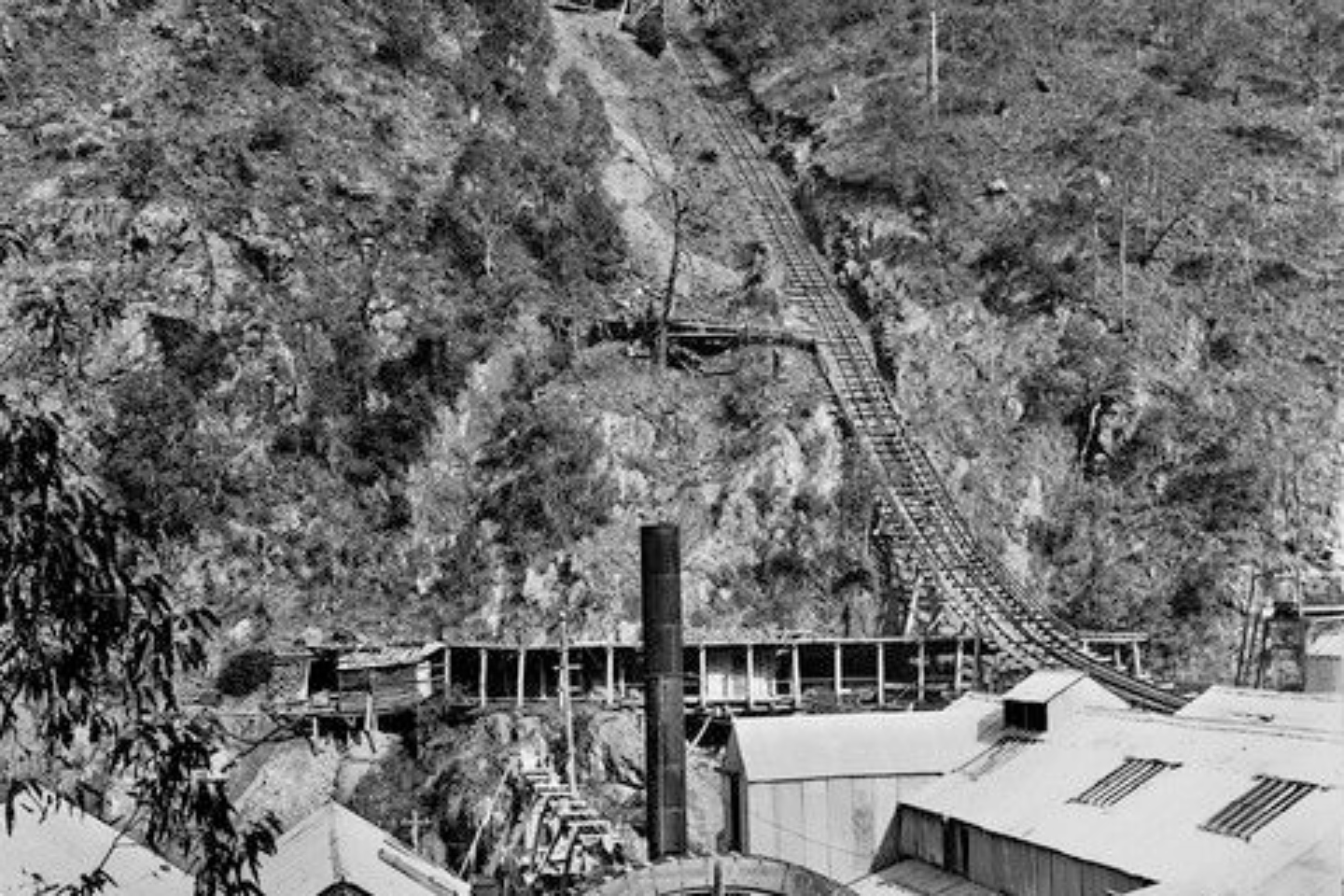

Four of those segments almost completely surround Larvotto’s Hillgrove gold-antimony mine, processing plant and infrastructure which sits about 23km south-east of the regional centre of Armidale.

The 358 sq km Rockvale project not only encloses potential north-west strike extensions of the geology and structures that host Larvottos’ Hillgrove gold-antimony mineralisation but also includes dozens of gold and antimony occurrences, including a number of high-grade historical workings.

The four main segments of the Rockvale licence are endowed with a remarkable scattering of gold-antimony prospects.

Among these prospects, the better-known include the Little Nell/Great Britain mine with grab samples up to 33.5g/t gold and Tait’s Gully with grab samples up to 76g/t gold and 318g/t silver, including 1.39 per cent antimony, both of which are situated north of Armidale.

To the north-east, grab samples at Girrakool came up with 590g/t silver and 18.2 per cent antimony, while only 7km to the south in the same licence segment samples from Union Jack gave up 3.7g/t gold, 1640g/t silver and 0.23 per cent antimony.

In the south-easternmost licence segment, about 12km north-east of Hillgrove, the Thorpleigh prospect yielded grab sample results of 1.57 g/t gold and 1.25 per cent antimony right next to the Hillgrove Fault and the Achill prospect produced 265g/t silver and 4.65 per cent antimony in grab samples.

In addition to the prospectivity indicated by the widespread scattering of old diggings, the various grab samples across the project, and its contiguous association with Larvotto’s Hillgrove ground, the Rockvale licence also sits in the core of a major and long-recognised gold-antimony district.

The district includes other players including Trigg Minerals' contiguous Spartan West antimony project to the north of Thunderbird and Lode Resources’ contiguous New England antimony project, to the north and north-east.

Additionally, Critical Resources’ vast Hillgrove South antimony-gold project sits in the south and south-east, along with Koonenberry Gold’s recently-acquired Enmore gold project 15km south.

The second and northernmost 1320 sq km Kookabookra project comprises a single licence centred about 68km north-north-east of Armidale and covers multiple gold reefs in the historical high-grade Kookabookra goldfield.

The company sees the licence area as prospective for intrusion-related gold mineralisation such as the Timbarra gold deposit about 100km north of the Thunderbird’s Kookabookra project which boasts a total mineral resource of 16.8 million tonnes at a grade of 0.73g/t gold for 396,800 ounces of gold.

The Kookabookra gold field’s reported historical gold mineralisation occurs in multiple quartz veins and reefs within the Kookabookra monzogranite which were historically mined for high-grade gold between about 1870 and 1890.

The most notable of the old workings include the Welcome Stranger and Pilgrim’s Progress reef which have produced grades of up to 42.6g/t gold and the Kookabookra Reef from which vein-quartz rock-chips assayed up to 18.5g/t gold and 0.33 per cent antimony.

Additionally, the far north-west of the licence area hosts the Mt. Secret prospect with up to 17m going 0.43g/t gold from 10m in one drillhole and 1m assaying 2.5g/t gold from 32m in a second hole.

About 1.5km south of Mt. Secret, the Mannix prospect yielded 12m at 0.53g/t gold from 10m and two other intercepts of 13 and 15m which gave up 0.41g/t gold and 0.37g/t gold, respectively.

Thunderbird Resources executive chairman George Bauk said: “This Proposed Acquisition provides an enormously exciting, low-cost opportunity for Thunderbird to acquire highly prospective exploration tenements in the heart of Australia’s emerging antimony district. The projects surround Larvotto Resources’ Hillgrove Gold-Antimony Project, a top-ten antimony resource globally and scheduled to commence production in early 2026. Notably, the geological structures that host Hillgrove’s deposits potentially extend north-west into Thunderbird’s newly acquired tenements, which also host numerous historical prospects and targets with significant antimony results, including 18.2 per cent antimony.”

Initial work planned for the Rockvale gold-antimony and Kookabookra gold project will concentrate on compiling all historical exploration and publicly-available geological data to identify high-priority targets.

Early reconnaissance of those targets will likely include geological mapping, rock-chip and soil sampling and detailed aeromagnetic data acquisition and/or new magnetic surveys.

Larvotto’s recent acquisition of Hillgrove turned out to be a strategic move which has transformed the company from an explorer to a developer.

The Aussie gold price is still hovering around the A$4000 per ounce mark and the price of the critical metal antimony is already moving into plus-US$30,000 per tonne territory.

Those prices would seem to bode well for Thunderbird’s acquisition of such well-endowed and strategically-located ground which shares identical geology with the historic Hillgrove operation and is situated in a renowned regional-scale, high-grade gold-silver-antimony district.

Given the success enjoyed by Larvotto at Hillgrove, Thunderbird’s proposed acquisition nearby is certainly worth keeping an eye on.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au