ASX-listed 88 Energy has the drill bit spinning at its Merlin-1 exploration test site as the Alaskan oil hopeful looks to cash in on recent spectacular success by other oil explorers in the neighbourhood around its ground. 88 Energy spudded the Merlin-1 test well yesterday with 14 days of drilling now needed to reach the target reservoir in the oil-rich Nanushuk formation.

ASX-listed 88 Energy has the drill bit spinning, or ‘turning to the right’ as they say, in the North American oil patch at its Merlin-1 exploration test site. The Alaskan oil hopeful is looking to cash in on recent, spectacular success by other oil explorers in the neighbourhood of 88 Energy’s frozen ground.

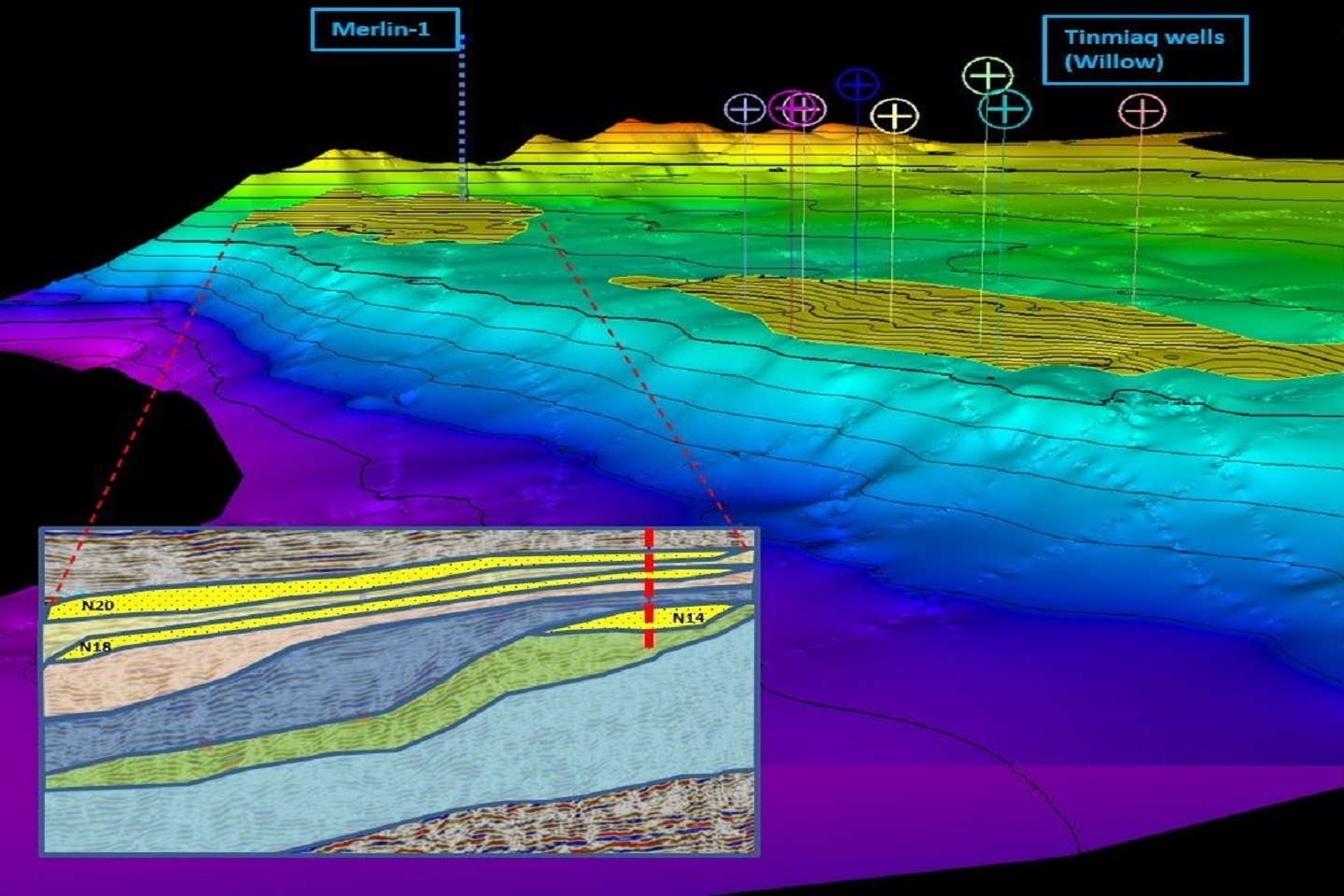

88 Energy spudded the Merlin-1 test well this week with 14 days of drilling needed to reach the target reservoir in the oil-rich Nanushuk formation. The drill bit will pass through the Nanushuk oil target above a final total depth for the well of around 6,000 feet, or 1,829 metres, below the surface.

The Merlin-1 test well is the first on the company’s Project Peregrine leases which 88 Energy secured when it took over fellow Alaskan oil hopeful, XCD Energy back in early 2020.

Perth-based 88 Energy has locked in a farm-in partner to do the heavy financial lifting with Alaska Peregrine Development Company, or “APDC” stumping up the first US$10m of the budget for the exploration hole to earn a 50 per cent interest in Project Peregrine.

However, 88 Energy said it could be up for as much as US$4m as its 50 per cent share of the extra costs over and above the farm-in amount after a review of expected drilling costs identified some overruns due to delays in receiving the permit to drill.

88 Energy recently rattled the tin and easily put together around $12m to pad out its balance sheet ahead of the spudding of the test well recently.

The top-up in funding gives the company a US$13m pile of cash to look after its share of the well operations it manages on the North Slope of Alaska over the next two weeks or so.

With ‘black gold’ the target for 88 Energy and its farm-in partner at the Merlin-1 test well site, the company will be hoping to emulate the success of ConocoPhillips at its 750-million-barrel Willow field and fresh-faced Harpoon oil discovery, both of which sit about 20 miles north, along the winter ice road of 88 Energy’s Harrier and Merlin oil prospects.

The company is targeting a gross mean prospective resource of 645 million barrels at Merlin, with Harrier chiming in with another 417 million barrels of gross mean prospective resource in the same Nanushuk target.

The region’s fossil fuel explorers recently unlocked the giant oil potential of the Nanushuk formation after drilling successfully into the topset sandstones of an ancient, buried delta, more than half a century since the discovery of the giant Prudhoe Bay oil field on the Arctic coast of Alaska.

A number of players now have a foot on land in the region including ConocoPhillips and Australia’s own Oil Search who recently took out a controlling interest in the Pikka oil field located around 50km east of the Willow find.

Oil Search also made a couple of fresh Nanushuk oil discoveries just last year, suggesting the oil play has some real legs to it.

88 Energy is hoping to join this new and illustrious pack of successful Alaskan oil diviners as it embarks on its journey to attempt pulling together around one billion barrels of oil at Project Peregrine.

Interestingly, the Merlin oil prospect sits just across the lease line from the dormant Umiat oil field which 88 Energy secured in a deal with the previous owners just last month. The company appears to be in the right address at just the right time, with almost 100 million barrels of proved and probable oil reserves to its name and ready to tap into at Umiat.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au