88 Energy’s hunch reservoirs charging an adjacent oil discovery might continue into its Icewine project acreage on the Alaskan North Slope looks to have paid off with third-party mapping interpreting three target reservoir units extending into the company’s permit areas. An in-depth petrophysical re-evaluation of Icewine-1 and the broader area has been carried out by independent petrophysical consultants.

88 Energy’s hunch reservoirs charging an adjacent oil discovery might continue into its Icewine project acreage on the Alaskan North Slope looks to have paid off with third-party mapping interpreting the three target reservoir units extending into the company’s permit areas.

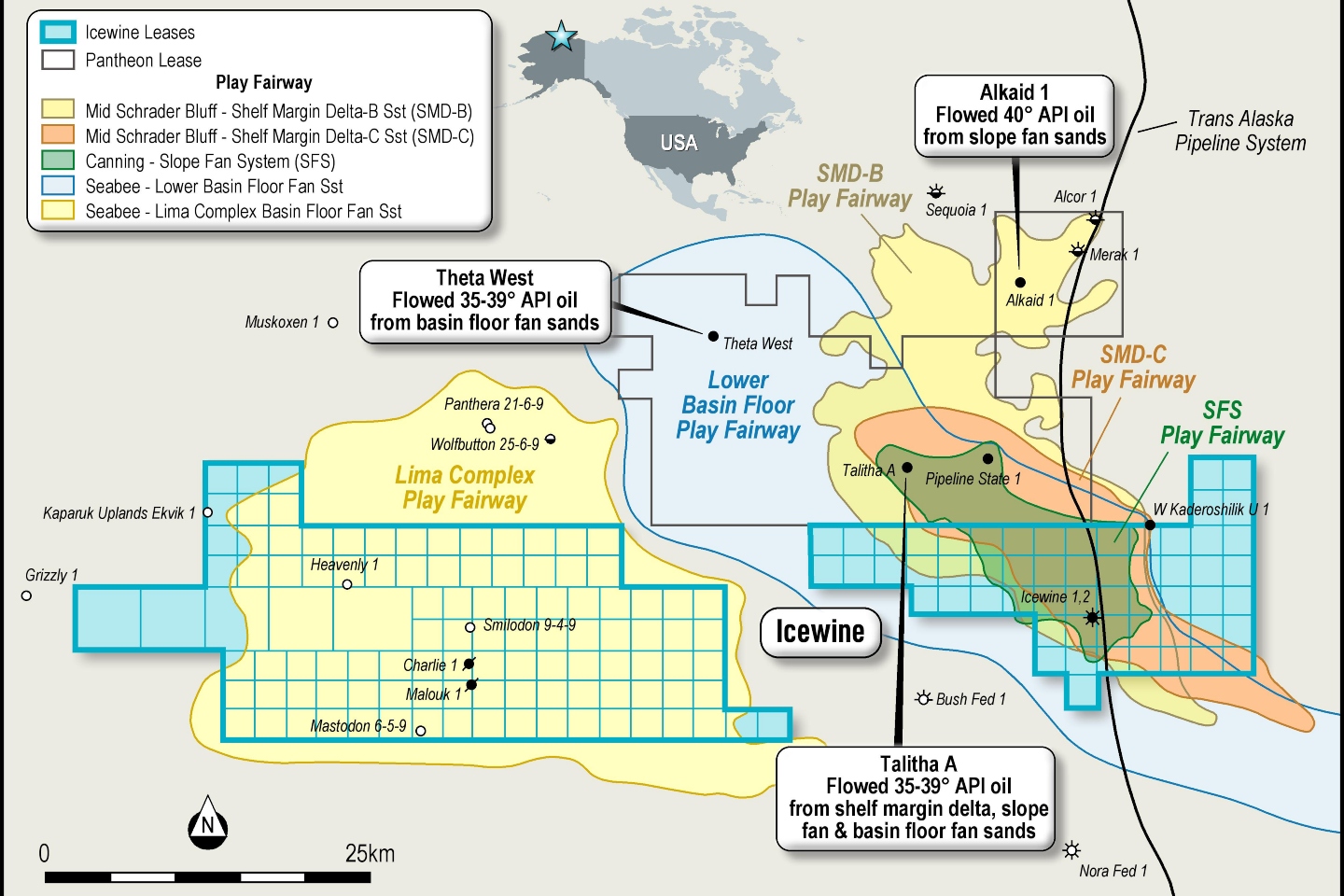

Three geological plays have encouraged 88 Energy – notably the Shelf Margin delta play, the Seabee lower basin floor fan and the Slope fan system reservoir sections where AIM-listed Pantheon Resources has enjoyed success through to the production testing stage and is now planning follow up horizontal production wells.

Independent consultants, Stimulation Petrophysics Consulting, conducted an in-depth petrophysical re-evaluation of Icewine-1 and the broader Icewine East area, focusing on assessing Icewine-1 logs against intervals that flowed oil in Pantheon’s acreage to the north.

The company said a comparison of the tested Shelf Margin delta reservoir unit in Alkaid-1 against a similar interval in Icewine-1 indicated the favourable potential for a flow test of the same zone in the Icewine acreage.

Data from the available well information from Pantheon reveals similar porosity and clay content in Icewine-1 with higher oil saturation and productivity estimates.

Pantheon drilled three nearby discoveries about 4.5 kilometres north of 88 Energy’s project boundary - Alkaid-1, Talitha-A and Theta West-1. The discoveries flowed 35 to 40 degrees API oil from multiple reservoirs and confirmed reservoir deliverability. The company is now planning the Alkaid-2 development well it expects to produce at rates of more than 1000 barrels per day, per well, via long horizontal wells with multi-stage hydraulic fracturing technology.

The public data from all three wells, the Stimulation Petrophysics report and 88’s own logs, will form the basis of an independent volumetric and risking certification the company expects to be complete in the next few months.

The potential new lease of life for the Icewine acreage is another positive step in rebuilding 88 Energy after its high risk, high-reward punt on the unconventional Nanushuk Formation yielded a non-commercial oil discovery in the two Merlin wells drilled in 2021 and 2022.

88 Energy Managing Director, Ashley Gilbert said: “We’re pleased and encouraged by the results of the independent third-party analysis at Icewine. Firstly, evaluation indicating Pantheon’s reservoir units extend onto our acreage at Icewine, and secondly, that the petrophysical analysis indicates favourable potential for a flow-test. We are optimistic on the future potential at Project Icewine and look forward to updating the market as efforts progress."

The company also reduced its cash burn by acquiring 75 per cent and control of a Texan oiler producing around 300 barrels of Permian Basin oil per day.

88 Energy spent US$9.7 million to take Bighorn Energy’s 32 wells across nine leasehold areas and is targeting a doubling of production by year’s end.

The deal, backdated to January 1, provides cash flows and low-cost upside to offset the balance sheet implications of drilling high impact exploration wells on a sole-risked basis.

The Permian Basin is one of America’s premier oil provinces and the geology of the Bighorn acreage is well understood, with low technical risk, bringing with it low-cost field development opportunities and potential acreage deals.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au