ASX-listed Lithium Australia’s proprietary processing technologies continue to demonstrate that metal dust from old lithium batteries, discarded low-grade spodumene and mine waste can be converted into lithium ferro phosphates for the manufacture of high-performance lithium-ion battery cathodes.

ASX-listed Lithium Australia’s proprietary processing technologies continue to demonstrate that metal dust from old spent lithium batteries, discarded low-grade spodumene and mine waste can be converted into lithium ferro phosphates for the manufacture of high-performance lithium-ion battery cathodes.

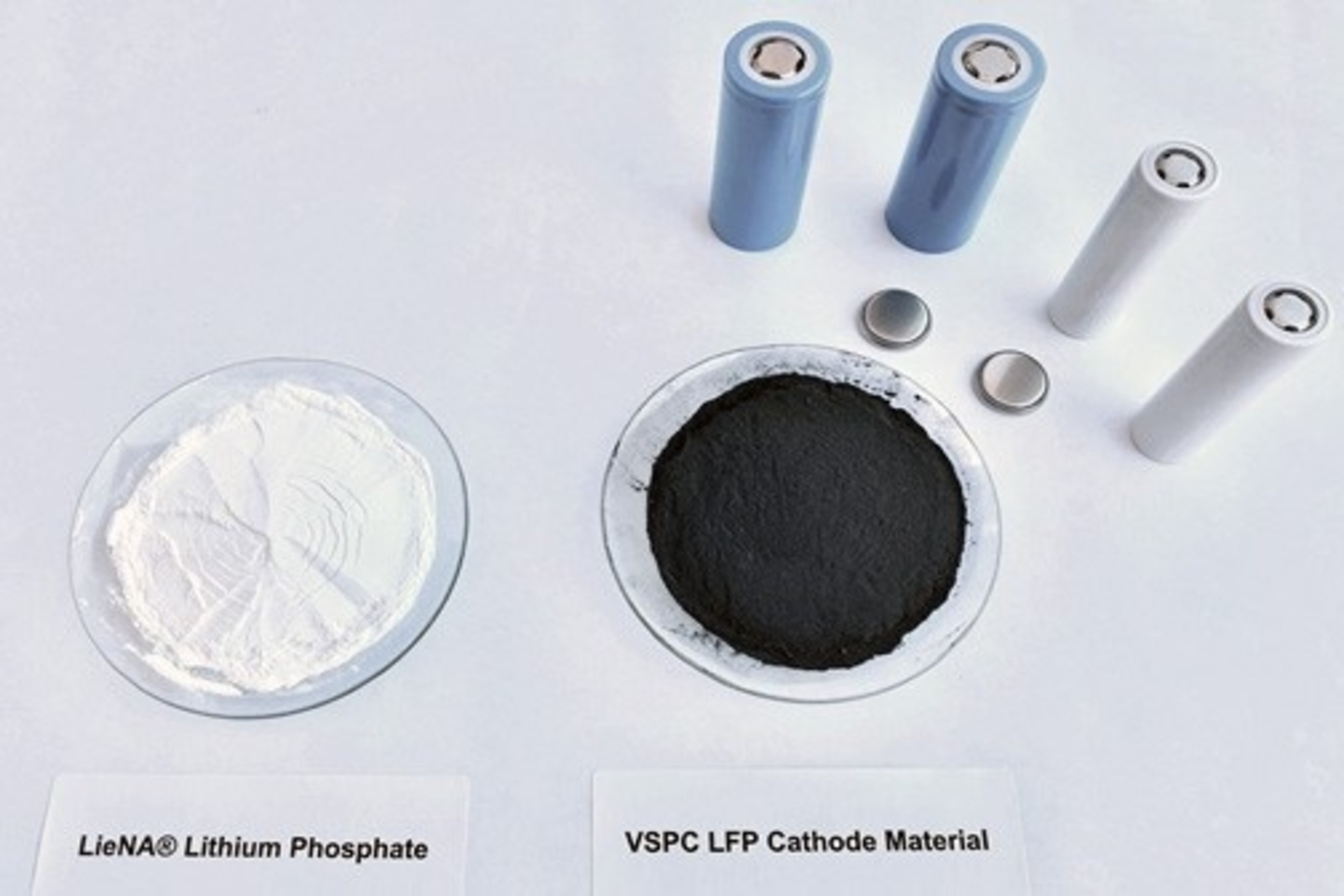

As part of its examination of the potential to recycle battery metals for the purposes of manufacturing lithium ferro phosphate, or “LFP” battery cathodes using its technologies, the Perth-based group tested battery cells containing the LFP material it produced and the results did not disappoint.

The test cell samples made from lithium phosphate recovered via Lithium Australia’s VSPC, LieNA and SiLeach processes all achieved energy capacities that exceeded the capacity specifications of commercial battery-cell manufacturers, according to the company.

The low-cost materials that the lithium phosphate was extracted from were mixed metal dust that came from spent lithium-ion batteries, fine or low-grade spodumene discarded from lithium concentrate production and lepidolite or mica from mining waste.

According to Lithium Australia, the positive results confirm high-quality cathode material can be created from lithium phosphate recovered from mineral waste and the recycling of lithium-ion batteries.

If Lithium Australia’s technology graduates to a commercial scale, it may ultimately have a significant impact on the lithium processing sector because it has the ability to monetise waste rock and otherwise spent material that was destined for the scrap heap, ensuring a low input cost for any commercial operator.

The company says its technology can also bypass the expensive lithium carbonate stage and go straight to the lithium phosphate stage, the product that is actually required by cathode manufacturers.

Lithium Australia says its discussions with battery-cell manufacturers in China and Japan are progressing and the company is sending them further samples for LFP product evaluation in larger-scale cells.

In the meantime, Tesla Chief Executive Elon Musk has opted for lithium ferro phosphate batteries for the new Chinese-produced Tesla Model 3.

Not only is the Asian market weighing up the possible LFP cathode benefits for electric vehicles but American and European automakers may also join the LFP queue soon, especially if fire protection systems in EVs powered by more traditional nickel, cobalt and manganese or nickel, cobalt and aluminium battery combinations are legislated.

According to S&P Global Market Intelligence, Germany and France increased their subsidies for EVs in 2019-20, culminating in a 45 per cent surge in EV sales in the EU for the year.

Lithium Australia Managing Director, Adrian Griffin said: "The availability of low-cost reagents for battery production varies from jurisdiction to jurisdiction. Our work may well result in Australia, and Western Australia in particular, becoming a more competitive environment for battery production.”

“The use of recycled materials can improve sustainability, reduce the industry’s reliance on conflict metals and help protect fragile ecosystems from the impacts of mining. We’re aiming for more ethical and environmentally acceptable outcomes for the battery industry as a whole.”

Is your ASX listed company doing something interesting? Contact: matt.birney@businessnews.com.au