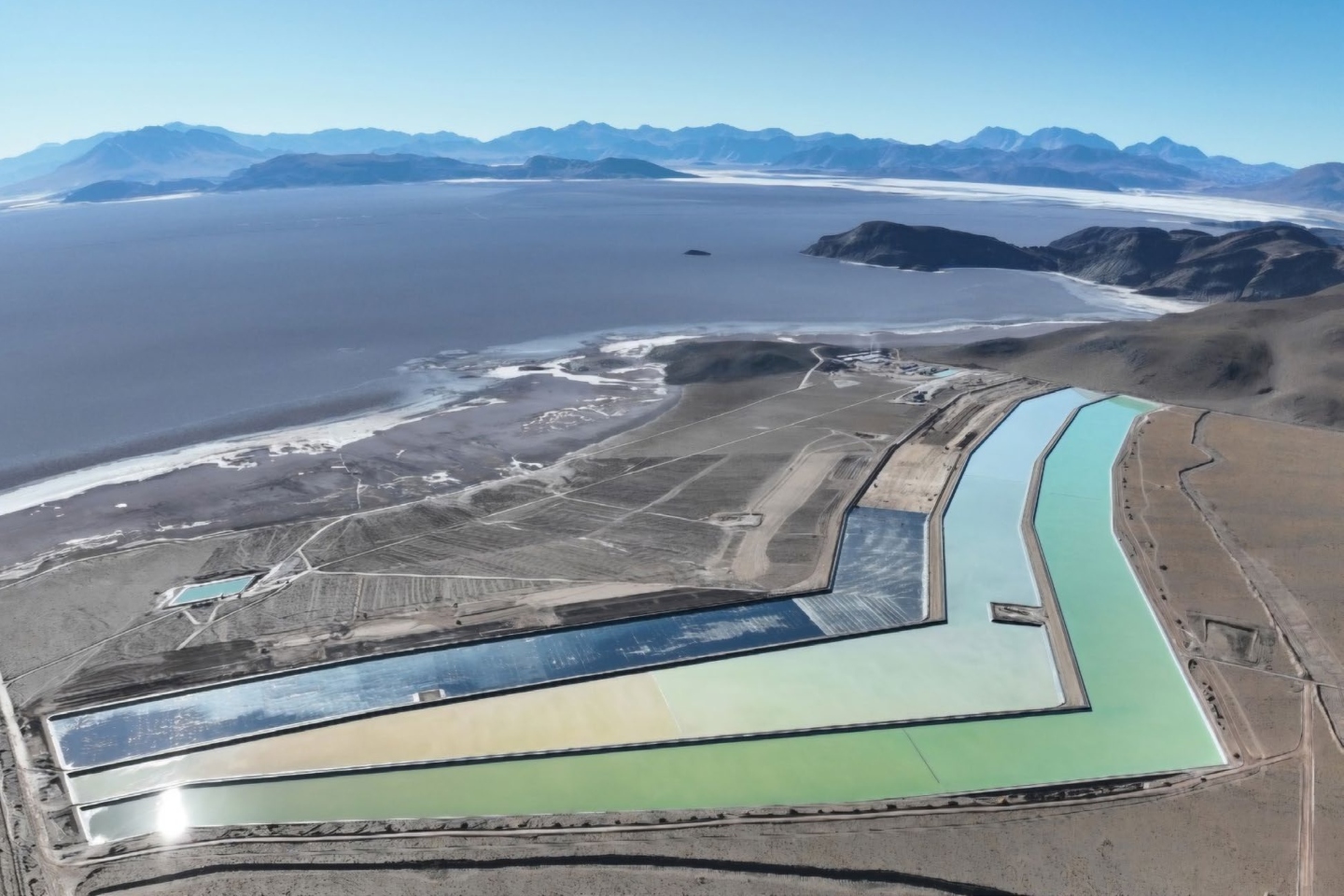

Galan Lithium says it already has a contained inventory of 1000 tonnes of lithium carbonate equivalent at its Hombre Muerto West project in Argentina as the initial evaporation process at the site builds steam. The company says about a third of the overall project has been completed, with total pond construction at 45 per cent and the first two evaporation ponds operating.

Galan Lithium says it already has a contained inventory of 1000 tonnes of lithium carbonate equivalent (LCE) at its Hombre Muerto West project in Argentina as the initial evaporation process at the site builds steam.

The company says about a third of the overall project has been completed, with total pond construction at 45 per cent and the first two evaporation ponds operating.

Management says about 600,000 square metres of the evaporation area has been built. It holds a contained inventory of 1000 tonnes of LCE and is capable of producing about 2400 tonnes of LCE per year.

The company is targeting first-phase lithium chloride production at the operation in the first half of next year.

Just last week, Galan took a major step towards selling product from the lithium brine project both locally and internationally after signing a crucial new deal with the Catamarca Government. Managing director Juan Pablo Vargas de la Vega and Catamarca Governor Raúl Jalil signed a commercial agreement that supports the grant of permits for the commercialisation of Galan’s lithium chloride concentrate.

The permits will allow for the domestic sale or export of lithium chloride concentrate and the company says it will continue work to place lithium chloride concentrate locally.

Galan Lithium managing director Juan Pablo Vargas de la Vega said: “With more than one third of the project completion now achieved, Galan is well on its way towards its targeted commencement of production in H1 2025.”

Proposed production at the project has been separated into four specific phases, starting with 5400 tonnes per annum of LCE next year. Phase two production is targeting 21,000 tonnes a year in 2026, before a significant increase during the third phase to 40,000 tonnes per year by 2028.

The final stage is predicted to produce 60,000 tonnes per annum using lithium brine sourced from both Hombre Muerto West and Galan’s other Argentinian brine project in Candelas.

Last year, Galan signed a binding offtake agreement with mining giant Glencore, which outlined the supply of up to 100 per cent of lithium products from phase-one production at Hombre Muerto West. To sweeten the deal, Glencore offered to provide a secured financing prepayment facility for US$70 million (AU$107 million) and up to US$100 million (AU$154 million), subject to conditions.

The agreement is for a five-year period from the start of the first phase of commercial production, with Glencore continuing to carry out the due diligence outlined in the arrangement.

Management says it is analysing options to reduce its capital expenditure, with the project expected to be in the first quartile of the lithium industry’s cost curve and with an initial reserve estimate of 40 years.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au