Australia has experienced a tumultuous year, avoiding the predicted property market crash as a nation, but coming out the other side with States having clashing views on lockdowns and quarantine.

Western Australia is set to be the highest growth state in Australia on the back of rising consumer confidence in the property market for buying houses but will face some challenges balancing deteriorating rental affordability as a result of low vacancy rates following the rent-rise moratorium which was lifted at the end of March.

Other major cities such as Melbourne are seeing their markets begin to rebound after a series of damaging lockdowns, with the volatility in Eastern States markets being a consequence of COVID-19 outbreaks.

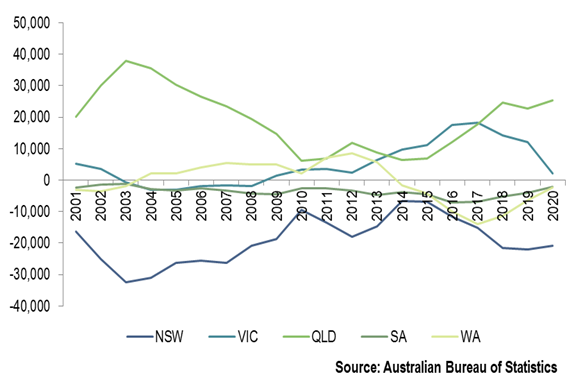

Queensland is a particularly interesting market, having been a significant beneficiary of the Australian COVID experience. Queensland did not have the same run up in house values as seen in the southern states between 2012 and 2018. This, in combination with fewer ‘stay-at-home’ lockdowns, has meant that Brisbane and the rest of southeast Queensland has not been as negatively impacted by COVID-19 as other major East Coast CBD’s. Less sensitive to overseas migration, Queensland has benefited from an increase in net internal migration as residents from the bigger cities of Melbourne and Sydney pursue the lifestyle on offer in Queensland and the value differential for housing.

Annual Net Interstate Migration

These demographic trends, further fuelled by the federal government’s targeted fiscal stimulus (the HomeBuilder grant) have resulted in significant housing demand in Queensland; with record levels of sales over $1m being achieved in the last quarter and very low vacancy levels. Lifestyle zones, including the Gold Coast and Sunshine Coast, have resulted in a spate of new developments to keep up with the increasing demand.

Rolling annual change in value of new Housing Finance Commitments by Buyer Type, QLD - AUD$ Billion (excl. refinancing)

This volatility appears to have exacerbated a long-term trend of major banks pulling back funding and reducing exposure to riskier assets such as shopping malls, hotels, B grade offices and residential developments. In this environment, it serves developers seeking funding, and investors seeking stable portfolios, well to consider alternate approaches to fund property development.

In contrast, the non-bank sector has remained steady in this environment. In fact, some experts believe that the non-bank share of the commercial real estate debt market has risen and will continue to surge over the next three years to hit more than $50bn by 2024 (Larry Schlesinger - Fin Review Oct 5, 2020). This growing sector brings more than funding certainty and rate competition; non-bank lenders generally specialise in niche areas of property, able to offer borrowers unique insights and guidance for the projects they are involved in.

“There’s a difference between funders who come from a background of financial structuring and engineering and those that come from a long and experienced background in property,” comments Dorado Property’s Danielle Nicholas, “If you're looking to fund a property deal, property expertise definitely helps particularly if you want to have a collaborative relationship with your funder. There’s so much more to the funding decision than price alone. You want an experience which at the end of the day you would like to repeat.”

Non-bank lenders that are relationship driven rather than opportunistic are valuable finds, as they prioritise project health and lend their skills to maximise the success of a project. This support has obvious benefits for developers, but the benefits extend to investors too. The flexibility and specialisation of non-bank lenders provides an appealing mix of stability and confidence in achieving above-market returns well-suited for diversifying investment portfolios.

While non-bank lenders have a newer position in Australia than the familiar and more established major banks, there are a number of strong, stable players establishing their reputations as highly trustworthy funders. “Borrowers are well advised to consider the track record of the various funders in the market,” says Danielle, “and place emphasis on track record and ability to deliver funds in the quantum, on the terms and in the time-frame that is originally promised.

“We’re hearing a growing number of stories where borrowers are being left high and dry at the 11th hour and without a loss upfront fees and no time to find alternative funding sources.”

Getting the funding is the first hurdle; however, the way a funder relationship works, after the funding is drawn down is just as important. Borrowers and investors alike should look for lenders’ relationships with their repeat clients, the consistency and transparency of their track records, the diversity of projects, and company responses to unforeseen circumstances all combine to give a sense of the suitability of a particular lender.

These factors are of increasing importance as the property finance sector becomes more crowded. Reputable lenders have genuine property development know-how as well as financial structuring expertise, and will set themselves apart with creative, outside of the box thinking - but not at the expense of understanding the specific development and the surrounding market.