ASX-listed, Blackstone Minerals has delivered a cracking 73 per cent lift to its nickel resource base at its multi-deposit Ta Khoa nickel, copper and platinum group elements project in northern Vietnam. A global resource base at the project taking in four deposits now clocks in at a hefty 130 million tonnes grading 0.37 per cent nickel for an eye-catching 485,000 tonnes of contained nickel.

ASX-listed, Blackstone Minerals has delivered a cracking 73 per cent lift to its nickel resource base at its multi-deposit Ta Khoa nickel, copper and platinum group elements project located about 160km west of Hanoi in northern Vietnam. A global resource base at the project taking in four deposits now clocks in at a hefty 130 million tonnes grading 0.37 per cent nickel for an eye-catching 485,000 tonnes of contained nickel.

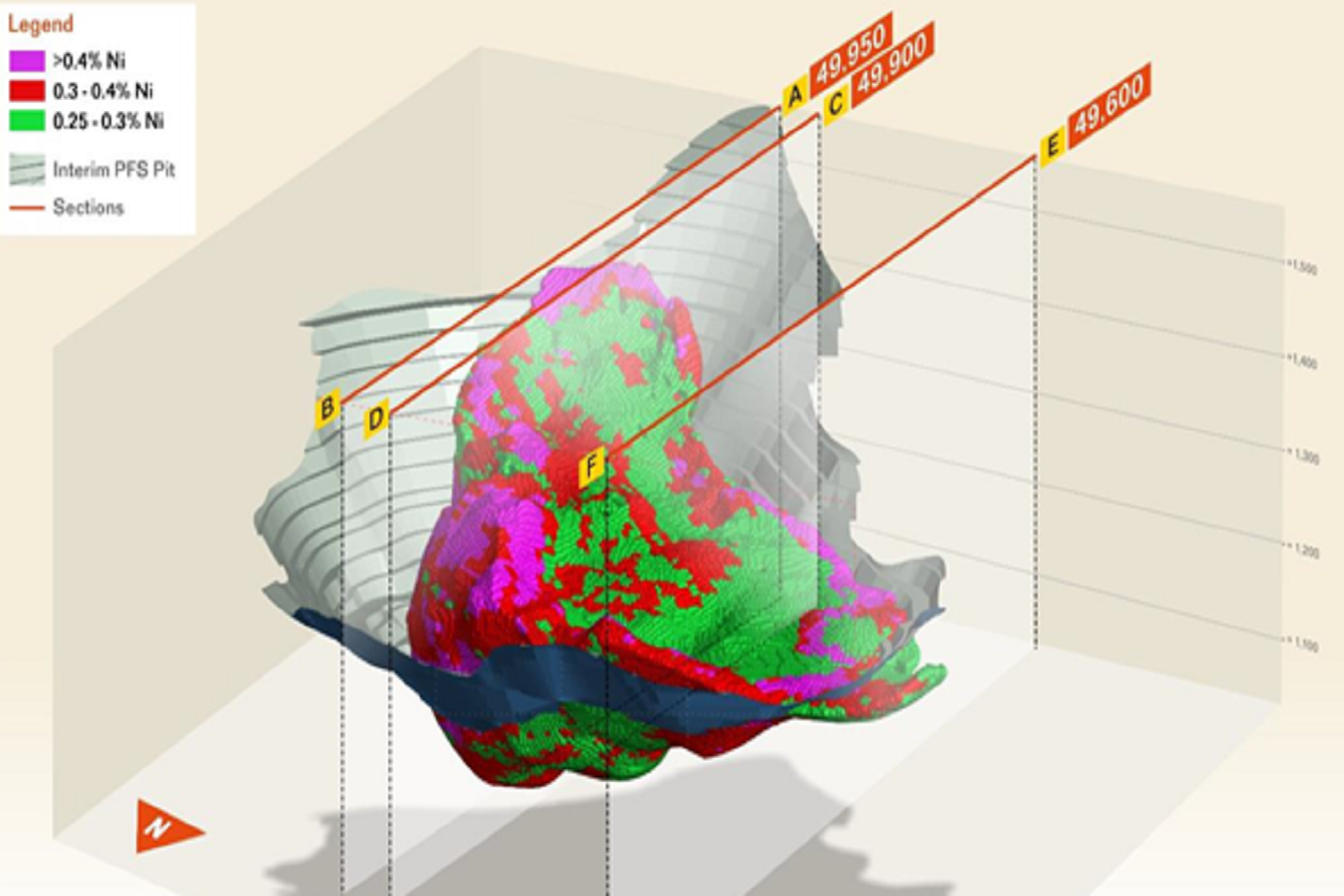

The resource upgrade for Blackstone’s flagship Ban Phuc deposit has returned 123 million tonnes going 0.37 per cent nickel for 452,000 tonnes of contained metal in the inferred and indicated categories.

Incorporating copper, cobalt, gold, palladium and platinum by-products, the Ban Phuc resource now contains 523,000 tonnes of nickel metal equivalent.

The company has also released maiden inferred resource estimates for its nearby Ban Chang, King Snake and Ban Khoa nickel deposits.

Some 6.2 million tonnes grading 0.31 per cent nickel has been estimated for its Ban Khoa disseminated sulphide nickel deposit.

At the Ban Chang massive sulphide vein deposit, an approximate 700,000 tonne resource grading a solid 1.2 per cent nickel has been recorded.

Another 430,000 tonne resource going 1.3 per cent nickel has also been defined at Blackstone’s King Snake massive sulphide vein deposit.

The four deposits now combine for a whopping 485,000 tonnes of contained nickel, or 571,000 tonnes of contained nickel equivalent.

Exploration drilling aiming to add more mineral riches to Ban Khoa, Ban Chang and King Snake remains ongoing. Blackstone plans to update the resource estimates for the three deposits once the campaigns are concluded.

Blackstone Minerals Managing Director, Scott Williamson said:“An aggressive drill out over the past twelve months has culminated into a global Ta Khoa Mineral Resource of enviable scale and increased confidence. Our Mineral Resource is an early indication of the potential of the Ta Khoa nickel sulfide district, with further aggressive testing already ongoing. Ban Phuc, our large bulk tonnage disseminated sulfide deposit, will underpin base load feed to a large concentrator that is being examined in our upstream Pre-feasibility Study. Ban Chang and King Snake are the first of many high-grade massive sulfide opportunities and the Company continues to work diligently to increase surety of nickel supply for our downstream refinery in Vietnam, with exploration and resource delineation at Ta Khoa being a core part of our strategy.”

Blackstone sees Ta Khoa as a district scale nickel, copper and platinum group elements project and is running a pre-feasibility study on a proposed mining, processing and concentrator operation known as its ‘upstream business unit’.

The company is also considering a possible ‘downstream business unit’ involving hydrometallurgical refining to produce battery-grade nickel-cobalt-manganese precursor products for Asia’s thriving lithium-ion battery industry.

Blackstone recently pocketed a cool A$60 million from an oversubscribed placement and share purchase plan that will see the bulk of the funds used to develop a ‘Phase 2’ pilot plant designed to produce commercial quantities of a nickel-cobalt-manganese precursor products.

The money will also contribute to feasibility studies at the project and be used to advance the company’s exploration efforts at its 90 per cent owned Ta Khoa tenure.

With a resource taking in 485,000 tonnes of contained nickel and a wallet full of cash to steam ahead with its Vietnamese venture, the stars seem to be lining up for Blackstone just as the price of nickel flirts with decade long highs at nearly $US20,000 per tonne.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au