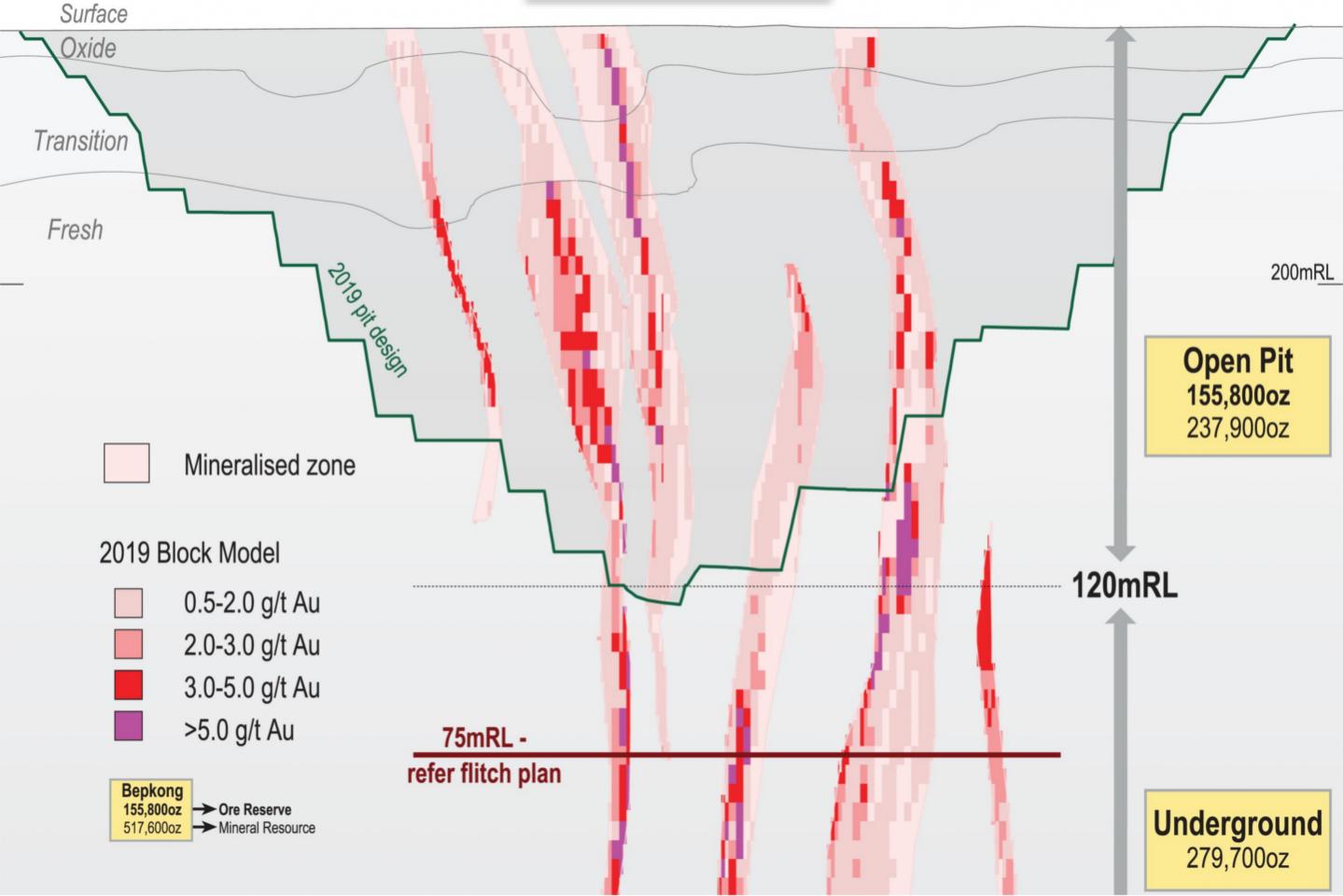

In a further demonstration that its Wa gold project in Ghana is still hiding significant ounces outside of the main Kunche deposit, Azumah Resources has delivered a maiden underground resource of 2.4 million tonnes grading 3.59g/t gold for just under 280,000 ounces at its exciting Bepkong deposit, just north of Kunche. The result more than doubles the previous Bepkong resource, now standing at 517,600 ounces grading 2.38g/t gold.

In a further demonstration that its Wa gold project in Ghana is still hiding significant ounces outside of the main Kunche deposit, Azumah Resources has delivered a maiden underground resource of 2.4 million tonnes grading 3.59g/t gold for just under 280,000 ounces at its exciting Bepkong deposit, just north of Kunche.

The result more than doubles the previous Bepkong resource, now standing at 517,600 ounces grading 2.38g/t gold.

Importantly the new resource estimate expands the global mineral resource for the broader Wa gold project to just under an impressive 2.77 million ounces, with 65% of that resource currently sitting at the higher confidence measured and indicated status.

Even more impressive at Wa is the ore reserve which has already cracked the magical million ounces at 1,028,200 ounces going 1.77 g/t gold – and that’s before any of the latest underground resource at Bepkong has been converted to reserves.

A scoping study to evaluate the technical and economic viability of potential underground mining at Bepkong is well underway and due for reporting by month’s end.

Management said that any underground ore extraction would likely be accessed by a decline from the base of the completed open pit at Bepkong, with open-stoping shaping up as the optimal mining method.

Importantly, any underground mining development at the Wa gold project would only need to cover its incremental capital and operating costs, as the project’s capital is expected to be paid back in just over a year and a half via the proposed open-pit mining of the Bepkong, Kunche and Julia deposits.

The company said that a number of the high-grade ore zones below the proposed open cut at Bepkong remain open at depth, are coherent over 300 metres of strike and located within down-plunge shoot positions.

Azumah is currently raising $2m via a share purchase plan, which will primarily be used to advance the feasibility study for the Wa gold project.

Managing Director Stephen Stone said: “Confirmation of a high-grade ‘underground’ mineral resource at our Bepkong deposit of 279,700oz grading 3.59g/t Au, including a combined measured and indicated resource of 167,500oz averaging 4.05g/t Au, provides a tremendous boost to Azumah’s fast-evolving Wa gold project in Ghana.”

“A scoping study evaluating underground mining at Bepkong will be reported later in July and our expectations are that this could have a materially positive impact on what is an already financially robust project.”

Extensive metallurgical test work at the Wa project previously confirmed high average overall gold recoveries of close to 92% for the combined Kunche, Bepkong and Julie deposits.

The company’s mineral resources have grown progressively through a focussed, systematic approach to the exploration of its licence holdings, which encompass large tracts of prospective Birimian terrain, the rock sequences that host the majority of West Africa’s economic gold mineralisation.

Much of the area is covered in soil, alluvium or laterite and hence, most discoveries have been “blind”, without the typical artisanal and historical gold workings so prevalent in other parts of Africa.

Azumah has two 15-year mining leases over its principal gold deposits, with the Ghanaian government holding a 10% free carried interest in its “rights and obligations”.

The region benefits from excellent regional infrastructure including grid power to site, good quality bituminised and non-bituminised roads, easy access to water and a 2km sealed airstrip at the regional centre of Wa, with good general communications.

It is shaping up to be a critical few months for Azumah as several important technical studies come together under the management of investment fund, Ibaera Capital, who is earning an initial 42.5% direct interest in the project by spending approximately A$16m on it over two years.

While it has been a long haul for Azumah, who listed on the Wa gold assets back in 2006, it certainly seems like the stars are finally aligning, with the company aspiring to be the next ASX-listed gold producer on the African continent.

Mr Stone added: “With the prevailing gold price well above the USD$1,300 per oz used in determining ore reserves, the case for development becomes even more compelling and, looking to the longer term, we still have many additional shallow and deeper targets to evaluate within our regional-scale 2,400 square kilometres of prospective tenure.”