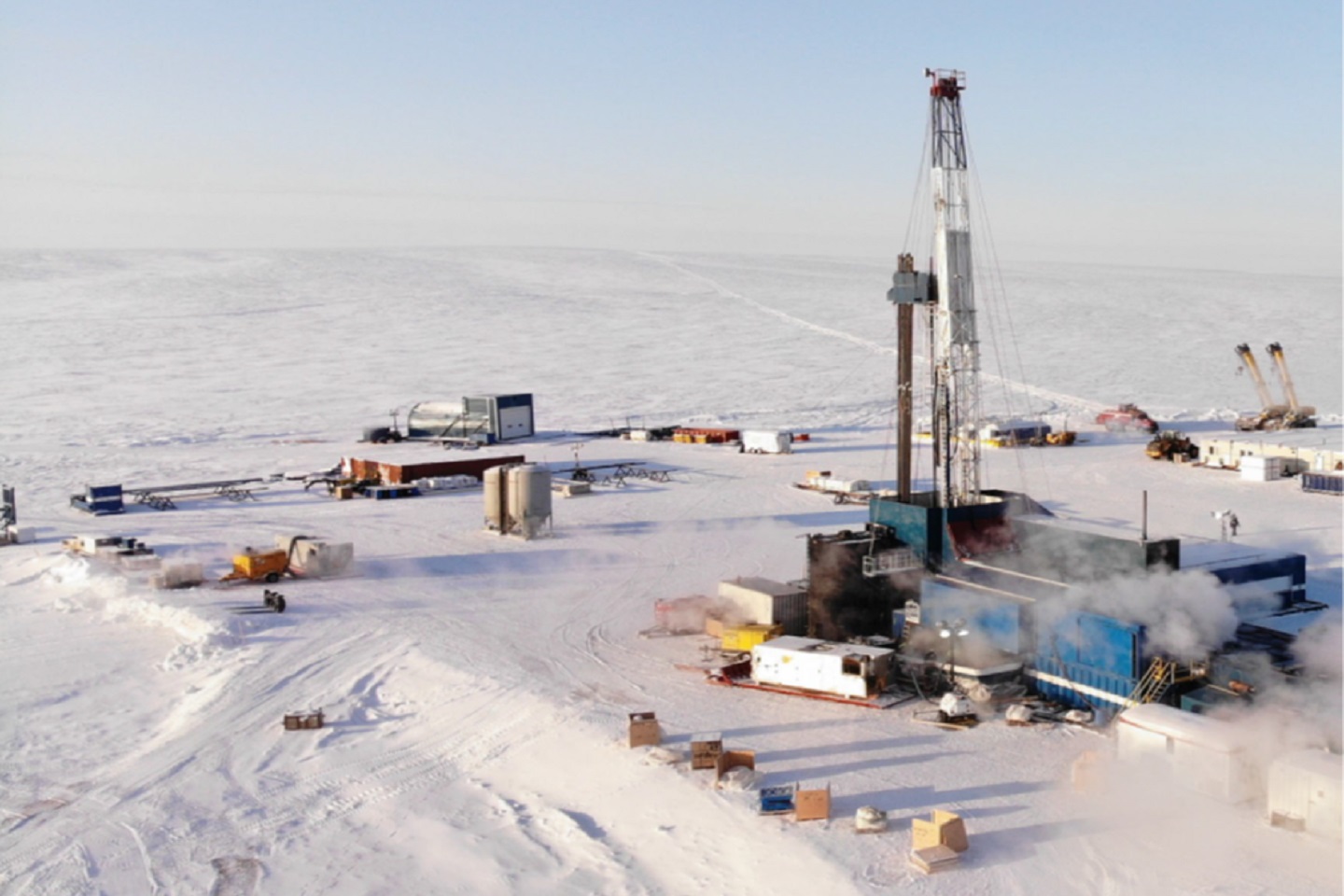

ASX-listed 88 Energy appears to have detected additional upside at its Umiat oil field on the North Slope of Alaska, immediately south of its Project Peregrine where it recently spudded the Merlin-1 well. The company says that analysis of Umiat 3D seismic data, together with post-well testing of Merlin-1, has revealed potential for additional reservoir sands at Umiat.

ASX-listed 88 Energy appears to have detected additional upside at its Umiat oil field on the North Slope of Alaska, immediately south of its Project Peregrine where it recently spudded the Merlin-1 well. The company says that analysis of Umiat 3D seismic data, together with post-well testing of Merlin-1, has revealed potential for additional reservoir sands at Umiat.

Management said the Merlin-1 drill campaign intercepted a thick section of an Umiat oil reservoir unit known as ‘Grandstand sands’. Wireline data collected over the intercepted interval is being evaluated in conjunction with 3D seismic data from Umiat.

The company says a seismic attribute analysis has now revealed potential for additional reservoir sands in the footwall of the Umiat structure.

Interpretation of the Umiat seismic data has enhanced the company’s understanding of the geometries and well control at Peregrine.

88 Energy has also secured approval from the Bureau of Land Management in Alaska for an amended work program at Umiat.

It says the new program will allow the company to defer its obligations to drill a well at the project for two years, enabling it to analyse the extensive amount of historical data it acquired when purchasing the project in January this year.

88 Energy now plans to use the extended time frame to optimise a full field development plan for Umiat which will incorporate potential synergies with Project Peregrine acreage. Information from Merlin-1 will also be used in the planning.

The company has already commenced a review of historical development plans for Umiat prepared by previous project owner, Linc Energy. Management says initial outcomes have already identified potential capital cost savings.

Alternative routes to market for the oil are also being evaluated which could include a potential tie-in to the Willow oil field being developed by ConocoPhillips to the north.

The company acquired Umiat from Malamute Energy and Renaissance Umiat for an overriding 4 per cent royalty interest and assumption of the liability for the abandonment of two Umiat wells drilled by Linc Energy in 2013-14. The approximate cost to abandon the two wells is US$1 million.

As part of the acquisition, 88 Energy picked up the 3D seismic data for the two Umiat leases which span an area of about 7,135 hectares.

The undeveloped Umiat project hosts gross 2P reserves taking in some 123.69 million barrels of oil. Of the overall total, 94 million barrels of oil are attributable to 88 Energy’s 76 per cent net revenue interest.

Just how big Umiat turns out to be remains to be seen however it appears that 88 Energy’s review of historical data and its own exploration works in Alaska may just be starting to bear fruit.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au